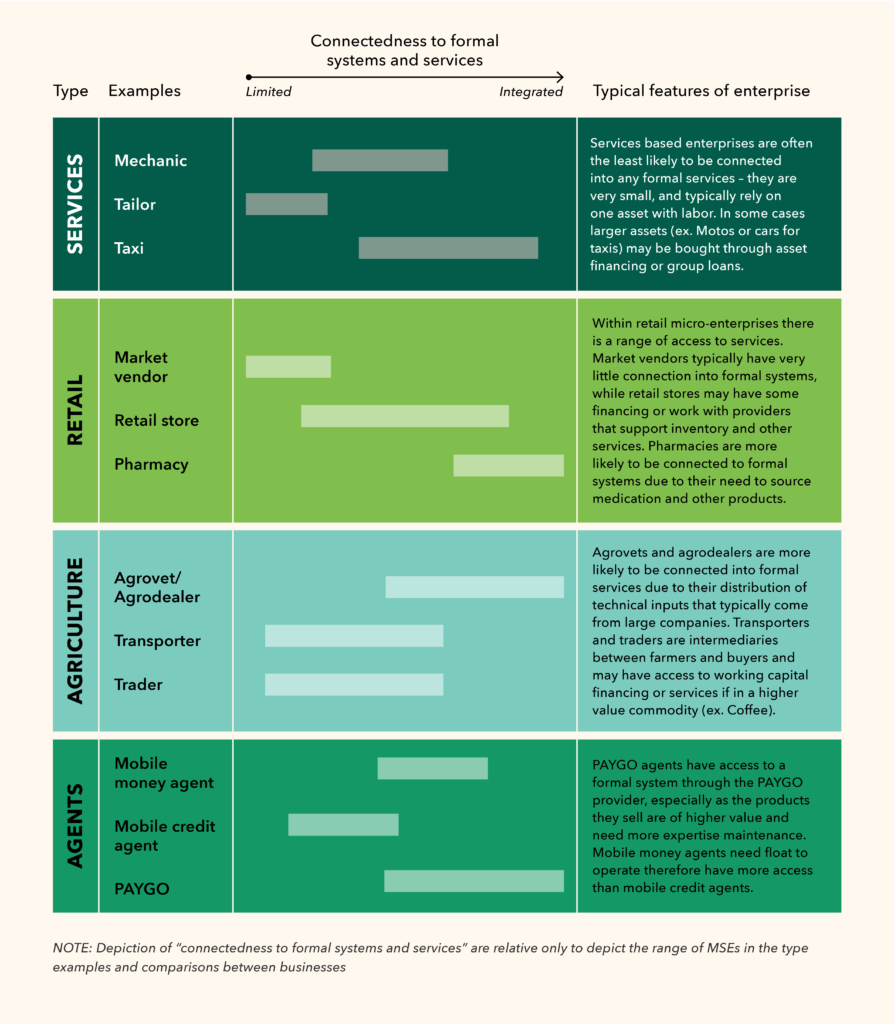

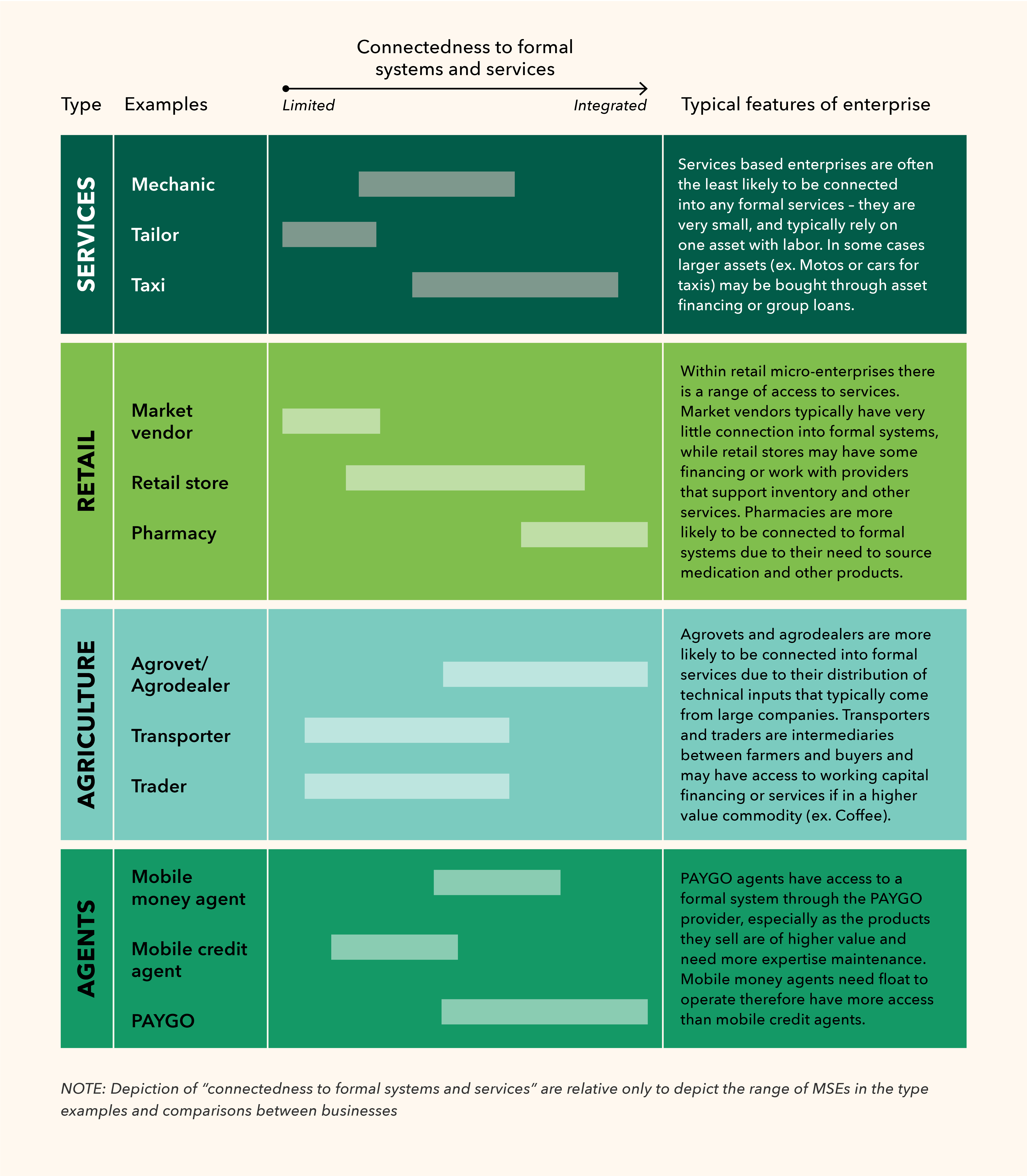

In the initial transition to this livelihood, the entrepreneur typically lacks management and formal financial literacy skills, and may struggle to find financing to start and develop their enterprise. While their business acumen may improve over time, they will continue to struggle with financial access. Rural, informal micro-entrepreneurs primarily rely on savings, community lending, and microfinance institutions (MFIs) for access to capital. Most of the financing and support for this pathway happens informally within communities. There are some formal support systems that have integrated these entrepreneurs into their agent networks—notably around mobile banking and PAYGO solar—however, this remains the minority.

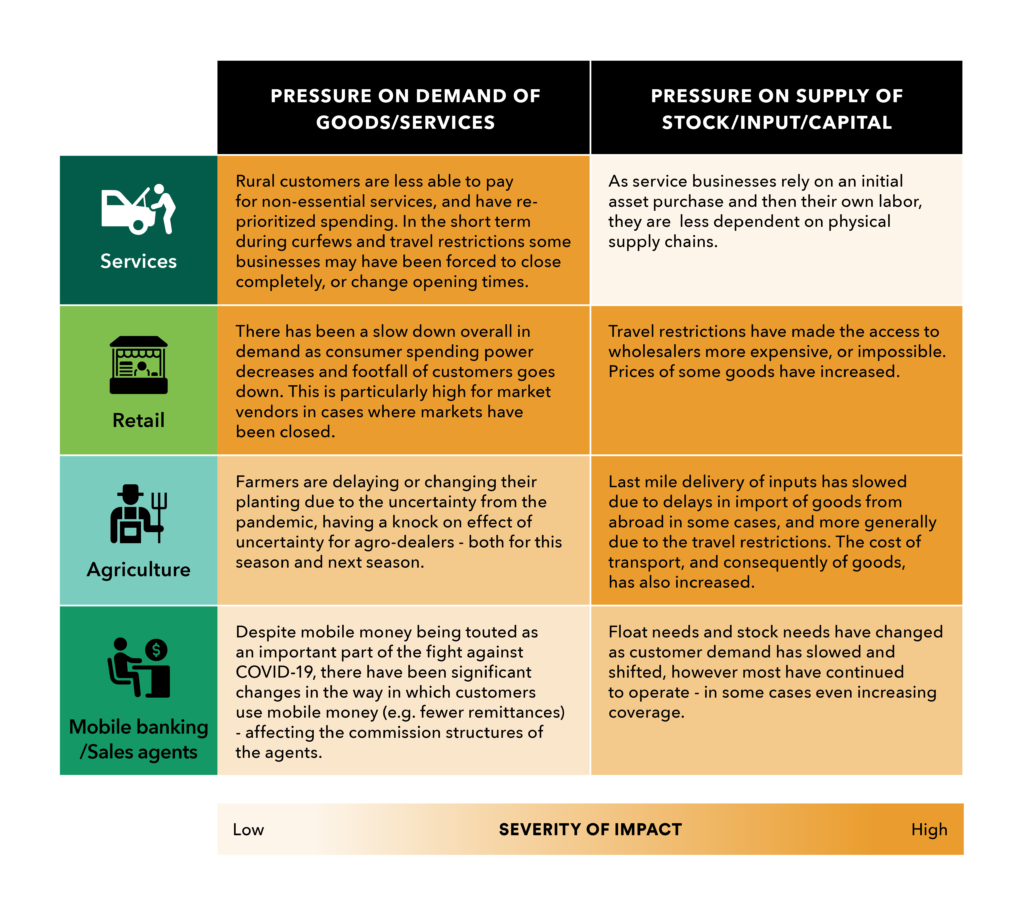

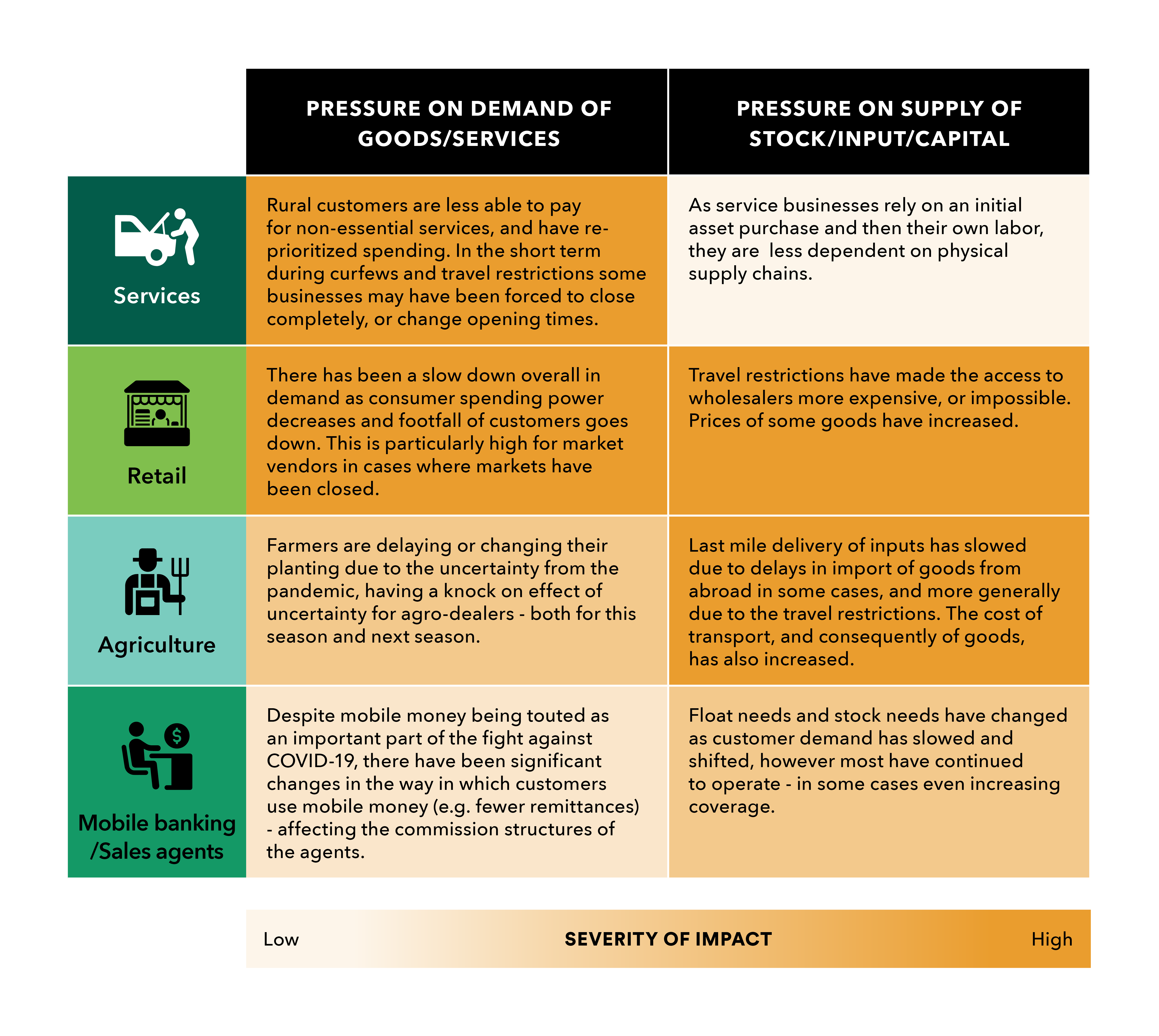

Informal micro-entrepreneurs are critical in their communities. They are the true last mile sources of goods and services, providing everything from school uniforms to seeds to phone credit. There are many different types of pathway 5 entrepreneurs, varying by region, country, and community. In this briefing, we categorize them according to four primary identifiers. It’s important to note that there are other identifiers not listed here, and that a single entrepreneur may operate a combined enterprise, particularly when providing agent services.

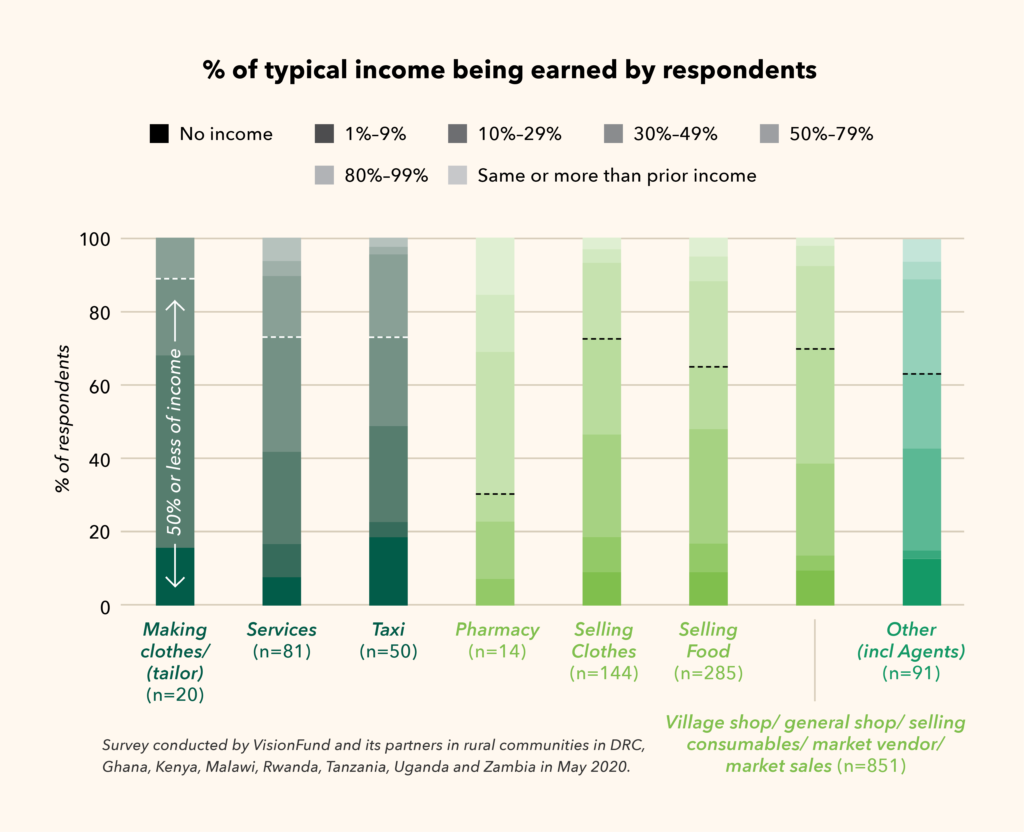

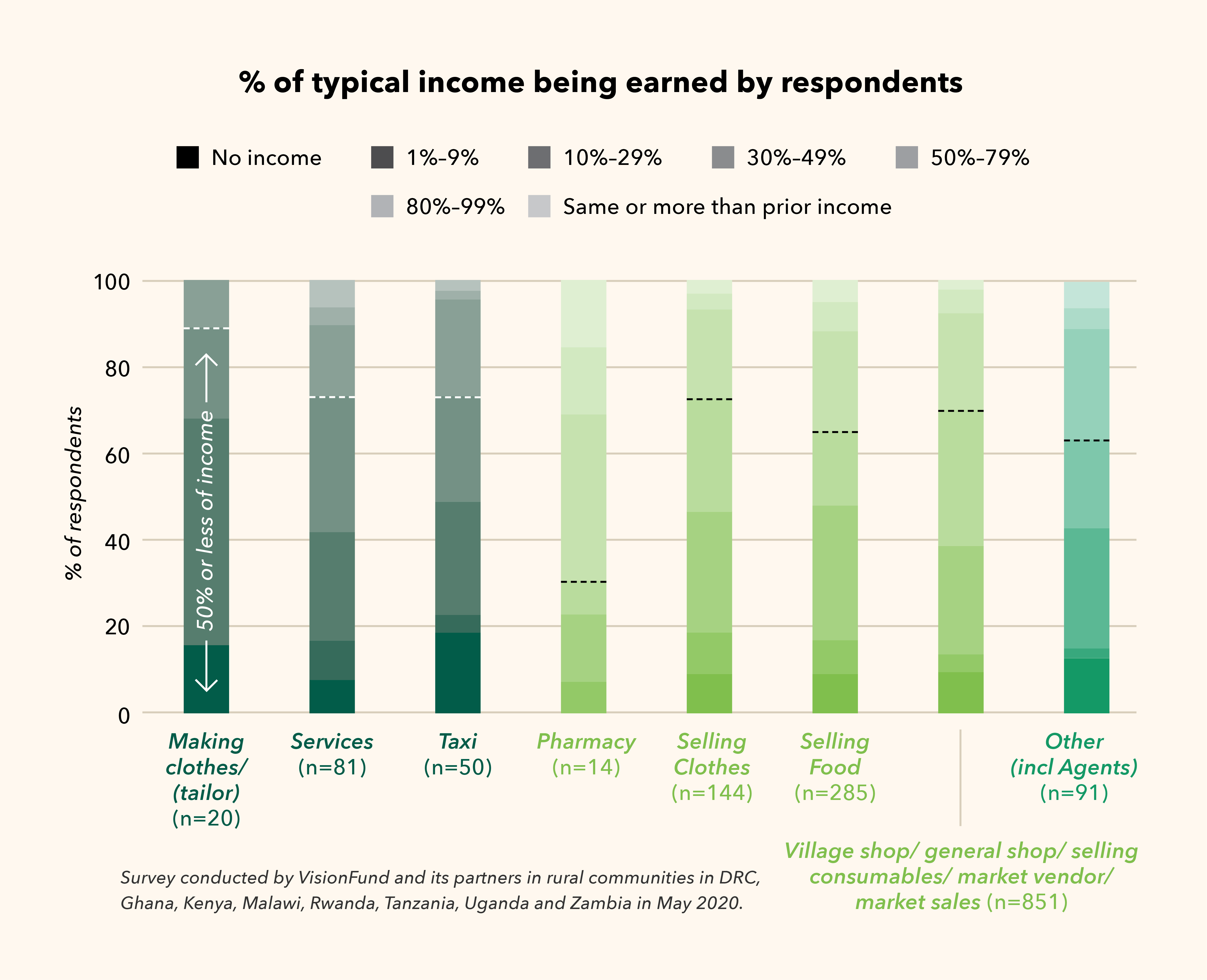

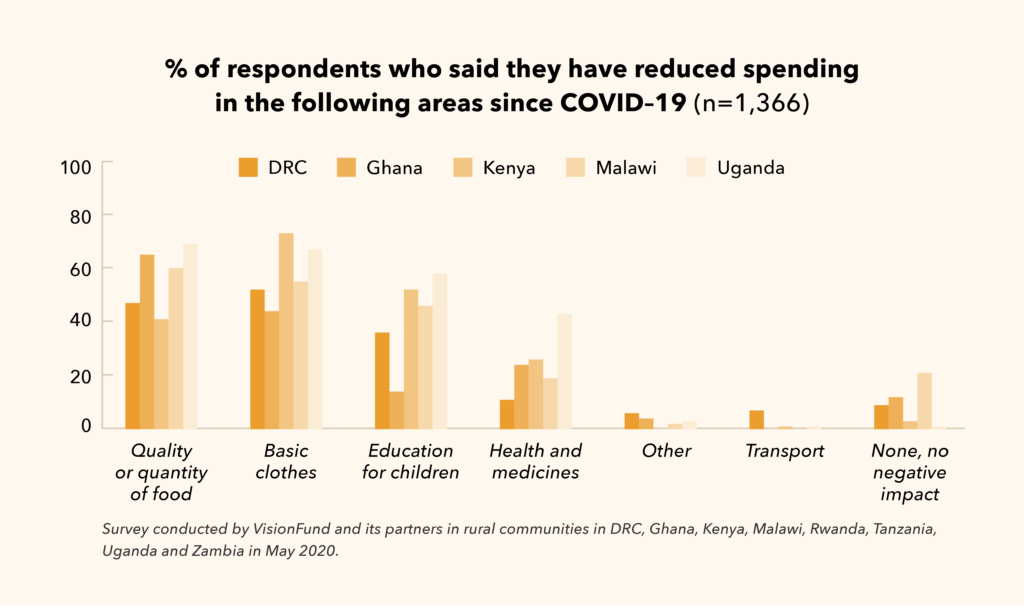

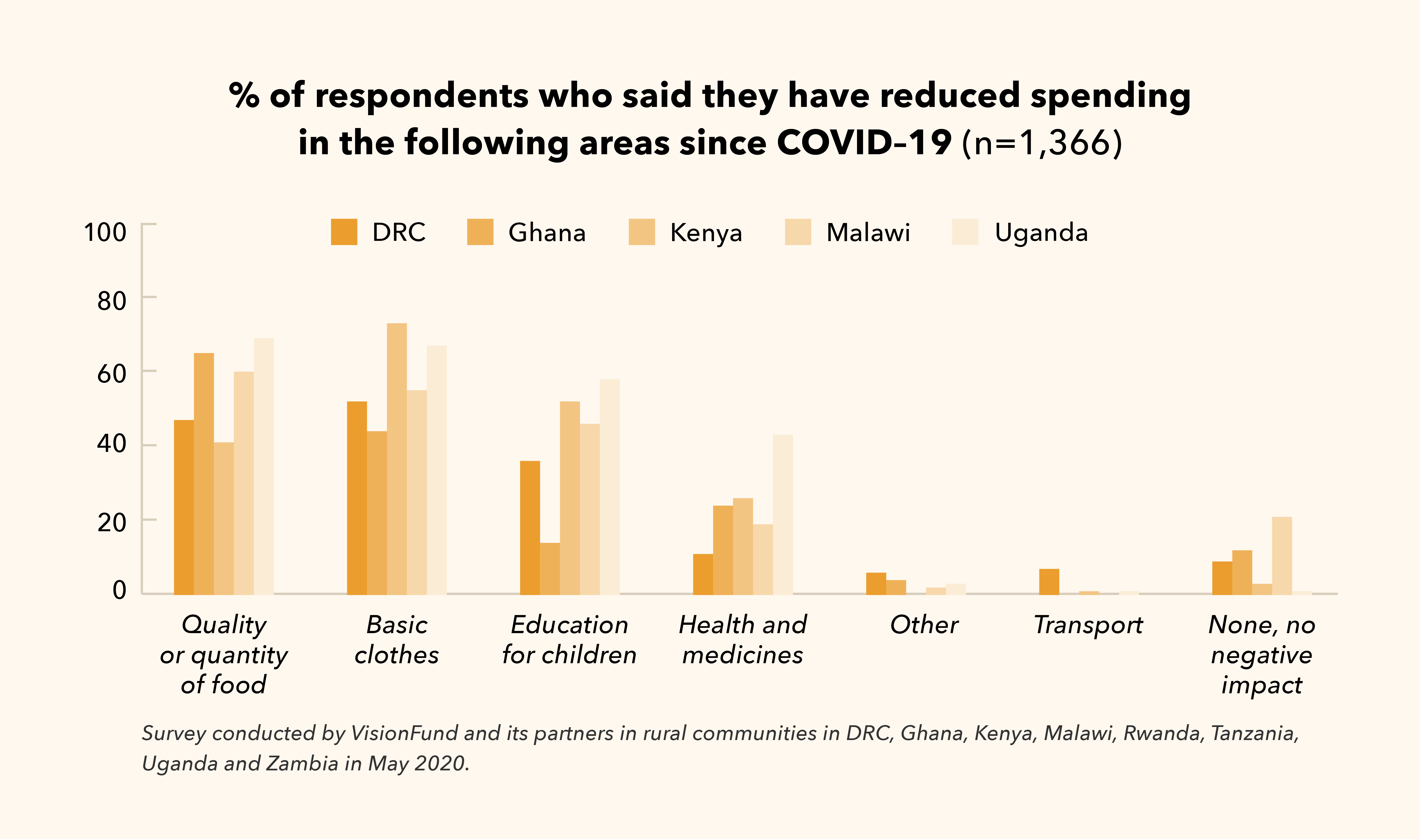

It is widely recognized that micro-entrepreneurs are critical in service provision in rural communities; however, due to their informal nature, there is limited data on their characteristics. Their lack of access to more formal systems and service providers also makes them more vulnerable to exogenous shocks, such as COVID-19.