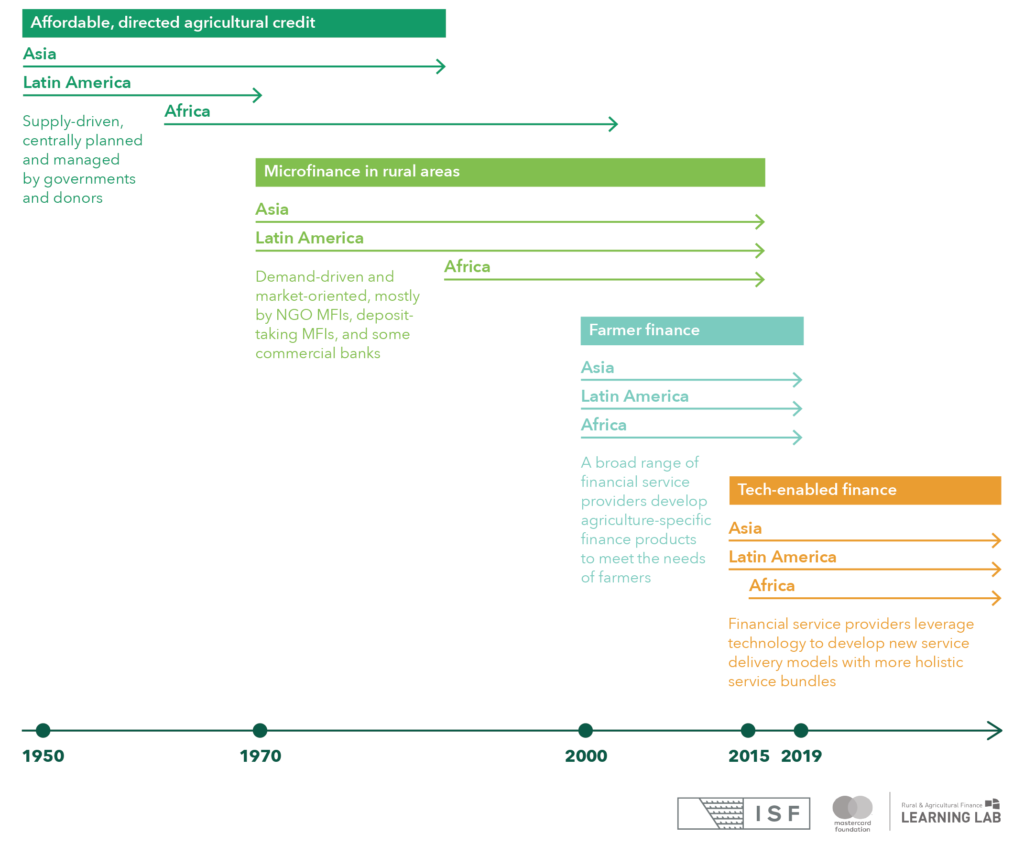

Smallholder financial services have continued to evolve since the 1950s, when the first government-led agricultural development banks were formed. In the 1970s, the next phase of smallholder financial services shifted focus to microfinance. In Inflection Point, we documented the evolution of farmer finance, involving a growing community of practitioners collaborating across sectors to develop new financial products. Now, three years later, we are at another point of transition. We have seen an unmistakable acceleration in technology-driven innovation, which has powered changes in existing rural finance models and facilitated the bundling of services in new ways.

But technology is not the only thing that’s changed. In 2019, there is a more expansive landscape of agendas, programs, and investments related to rural agricultural finance than ever before. This includes more diverse finance offerings and the recognition of the ways that rural agricultural finance intersects with critical global agendas, such as climate change, food security and nutrition, gender equality, and youth. The capital market for rural agricultural finance has also expanded, from a relatively small set of host country governments, agribusinesses, and donors to a larger ecosystem of capital providers with differing objectives and investment philosophies.