Pathways to Prosperity

2019 Rural and Agricultural Finance State of the Sector Report

Welcome to the 2019 Rural and Agricultural Finance State of the Sector Report, a joint publication by the Mastercard Foundation Rural and Agricultural Finance Learning Lab and ISF Advisors.

Scroll for the key takeaways or click to explore the full report.

2019 Key Takeaways

How has the rural and agricultural finance sector evolved over the past three years?

The last three years have seen a rapid acceleration in technology-driven innovation, which has powered changes in existing rural finance models, enabled providers to develop new service delivery models, and facilitated the bundling of services in new ways. We have also seen a more diverse influx of service and capital providers, which has reshaped the market. But despite this progress, there remains a large, persistent gap in smallholder and agricultural SME finance.

There continues to be a persistent gap in smallholder and agricultural SME financing.

Establishing a dynamic view of rural household livelihood pathways is a big step forward for the sector.

Taking a pathways view can help funders channel capital more efficiently towards rural service provision.

Applying the pathways model can guide rural agricultural transformation in an inclusive direction.

Mobilizing the sector around four agenda-defining needs could bring us closer to closing the financing gap.

Establishing a dynamic view of rural household livelihood pathways is a big step forward for the sector.

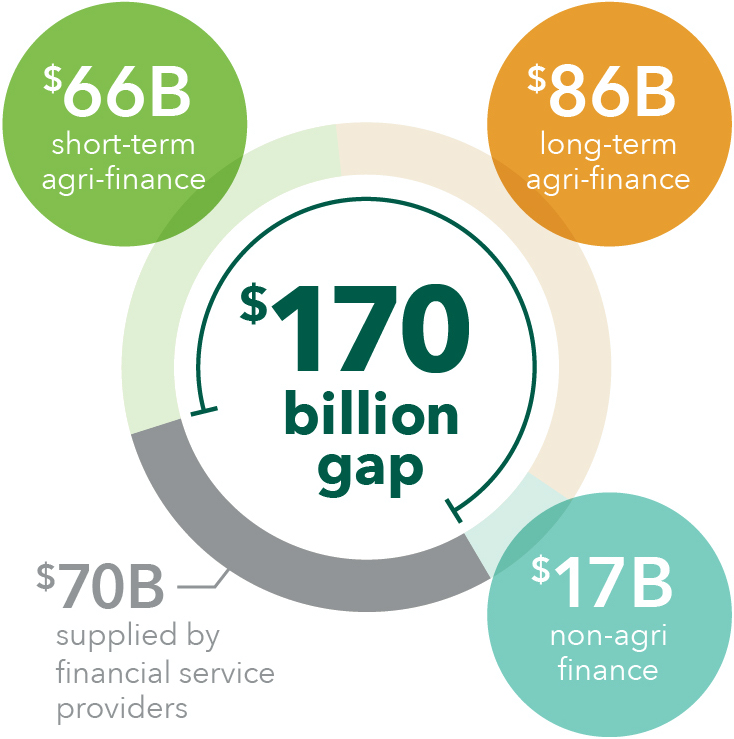

There continues to be a persistent gap in smallholder and agricultural SME financing.

An estimated 270 million households in South & Southeast Asia, sub-Saharan Africa, and Latin America consider smallholder farming an integral part of their livelihoods, and require around USD 240 billion in agriculture and non-agriculture finance. The latest data suggests that financial service providers are currently supplying USD 70 billion to smallholder households, leaving a gap of around USD 170 billion.

We also see a large gap in lending to agricultural SMEs. While there is no comprehensive global sizing of the demand and supply, a recent report by Dalberg and KfW estimated an annual lending gap of USD 100 billion to agricultural small and medium enterprises (SMEs) in sub-Saharan Africa alone. This gap cuts across all sizes of agricultural enterprises, but is especially prevalent for micro-SMEs as well as mezzanine and equity investments to SMEs.

Learn More

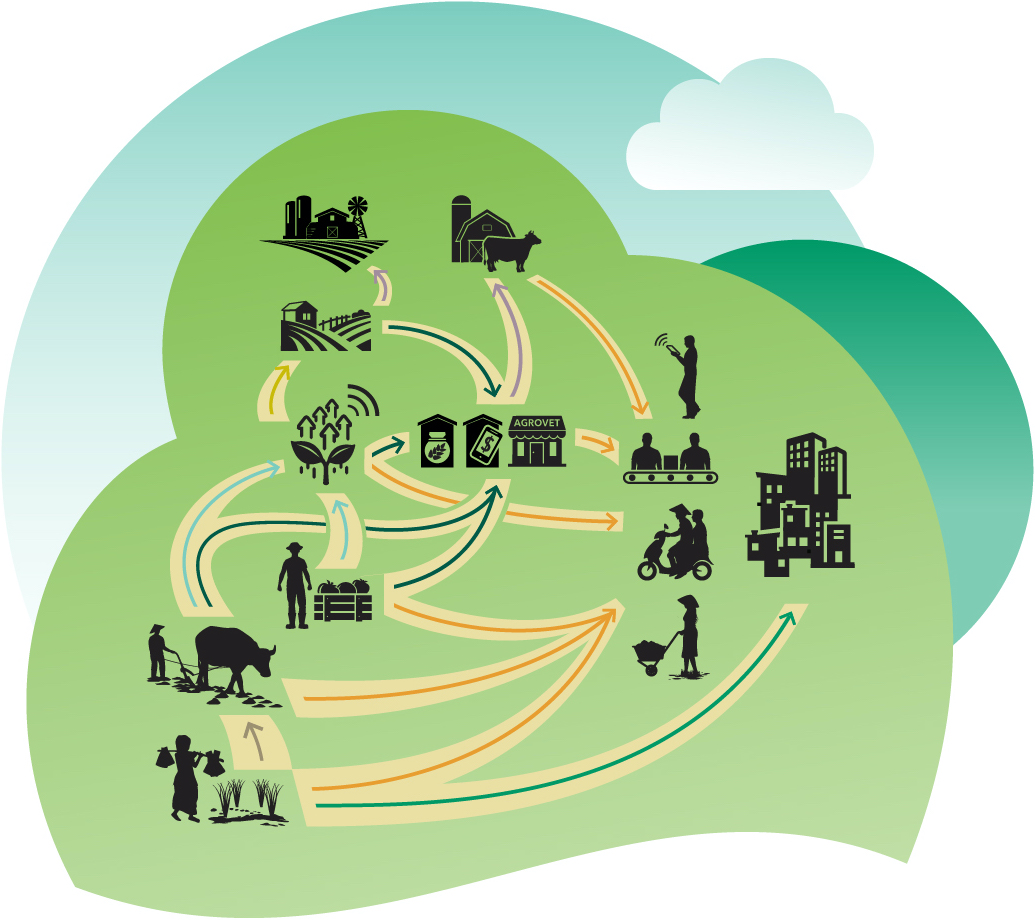

Establishing a dynamic view of rural household livelihood pathways is a big step forward for the sector.

Building on new research by CGAP, we have developed a Rural Pathways Model that describes a series of predictable development trajectories for smallholder households as they pursue resilience and agency through various livelihood strategies. This model moves us from a static understanding of smallholder households based on their characteristics at a particular moment in time, towards a dynamic view of how households might evolve as they move along the different pathways.

When applied to a specific context, these pathways can offer micro-and macro-level insights into how rural households’ needs change over time, and how that will shape the rural economy. This broader, more fluid framework for understanding the rural agricultural finance market opens opportunities to push the boundaries of innovation and inclusion in our sector.

Learn More

Taking a pathways view can help funders channel capital more efficiently towards rural service provision.

The misunderstanding of the impact-return trade-off continues to be a major challenge for the rural agricultural finance sector. Without a clear understanding of the different service delivery models — the differences in underlying client profiles, quality outcome, and impact data — it’s nearly impossible to assess the impact-return tradeoff and accurately evaluate the need for subsidy to support certain business models.

By taking a pathways view of impacts and returns, we can begin to create more comparability between service delivery models and providers, which will shed more light on the impact-return tradeoff. This can help funders channel the right type of capital to the right service providers at the right time, and ensure that their subsidy is utilized in a “smart” and efficient way.

Learn More

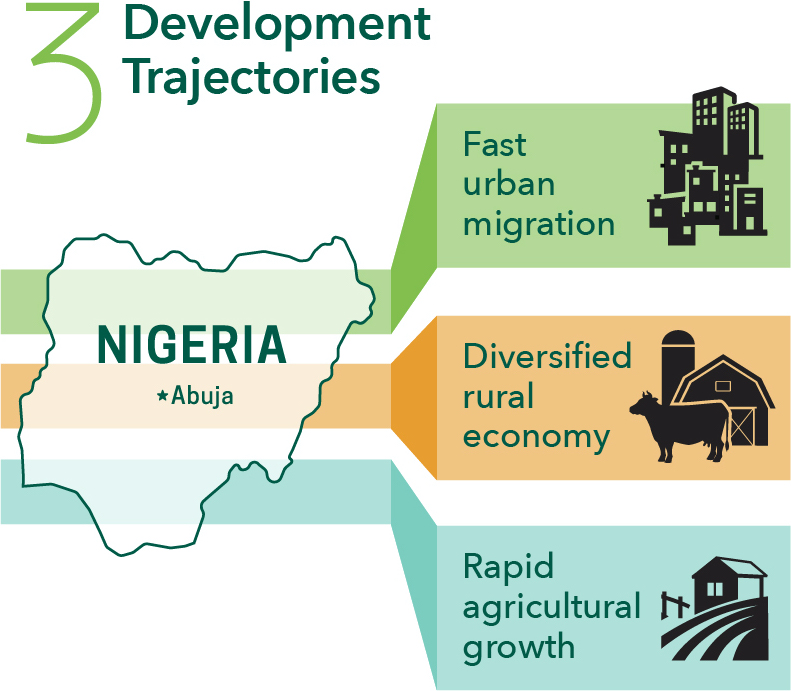

Applying the pathways model can guide rural agricultural transformation in an inclusive direction.

There is a growing evidence base showing that without transforming agriculture, no country with a major agricultural sector has become a wealthy, industrialized country. The process by which countries have transformed their rural economies varies from case to case. Whatever the path a country decides to follow, these drivers of agricultural transformation can either be socially and economically inclusive, or exclusive, for rural populations. In all cases, transformation requires decades of sustained investment and delivery of public goods and services.

The rural pathways model can be a powerful tool for considering the current shape of a given rural economy and informing tough decisions about where and how to invest in inclusive rural transformation.

Learn More

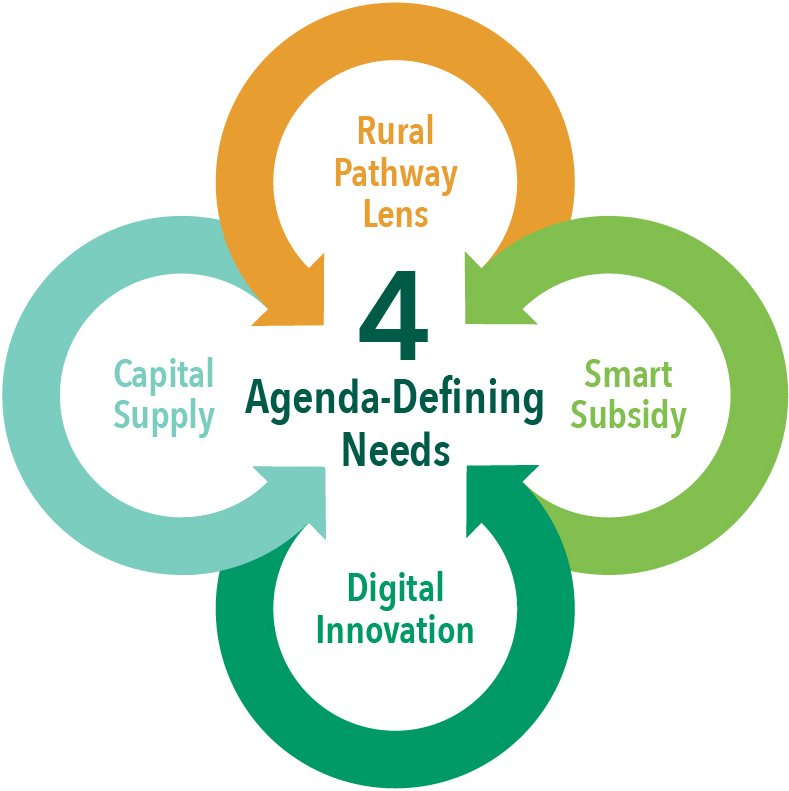

Mobilizing the sector around four agenda-defining needs could bring us closer to closing the financing gap.

While significant progress has been made over the past three years, the sector needs to mobilize around four agenda-defining needs moving forward to close the financing gap for smallholder farmers and agricultural SMEs:

- The sector needs to think dynamically and long-term about rural clients through a rural pathways lens.

- Capital providers need to get smarter about matching their subsidy to service providers by making different asset classes more clear and transparent.

- Continued funding is needed to realize the promise of digital technologies.

- The sector needs to continue to innovate around how capital comes to market.

Sponsors & Partners

The authors would like to acknowledge and thank the sponsors, advisory committee members, and partners of this work. Their generous contribution of time, guidance, and support was critical to the success of this report.

Samuel Ssenyimba, The Bill and Melinda Gates Foundation

Jamie Anderson, CGAP

Kusi Hornberger, Dalberg

Garron Hansen, Chemonics International

Patrick Starr, USAID Feed the Future

Mark Wensley, The Mastercard Foundation

Leesa Shrader and Christabell Makokha, Mercy Corps

Hedwig Siewertsen, AGRA

Stephanie Hanson, One Acre Fund

Tim Strong, Opportunity International

Brian Milder, Aceli Africa, CSAF

Bettina Prato, IFAD, SAFIN

Elizabeth Wilson, Small Foundation

Simon Winter, Syngenta Foundation

Iris van der Velden, IDH The Sustainable Trade Initiative

Calvin Miller, Independent Consultant

Authors

Clara Colina, RAF Learning Lab

Mikael Clason Höök, RAF Learning Lab

Matt Shakhovskoy, ISF Advisors

Core Research Support

Ayush Bhargava, ISF Advisors

Martin Slawek, ISF Advisors

Sommers Kline, ISF Advisors

Will Saab, ISF Advisors

Camila Saad, Dalberg

Jean-Charles Guinchard, Dalberg

Jesse Baver, Dalberg

Olwen Wilson, Dalberg

Analytical Support

CGAP

Nathan Associates

Key Input & Advisory Support