Rural agricultural finance was long considered a standalone agenda with the primary goal of generating productivity and resilience outcomes. But more recently, providers have come to see rural households as a meeting point for a number of critical global agendas, including climate, gender, youth, nutrition, and employment.

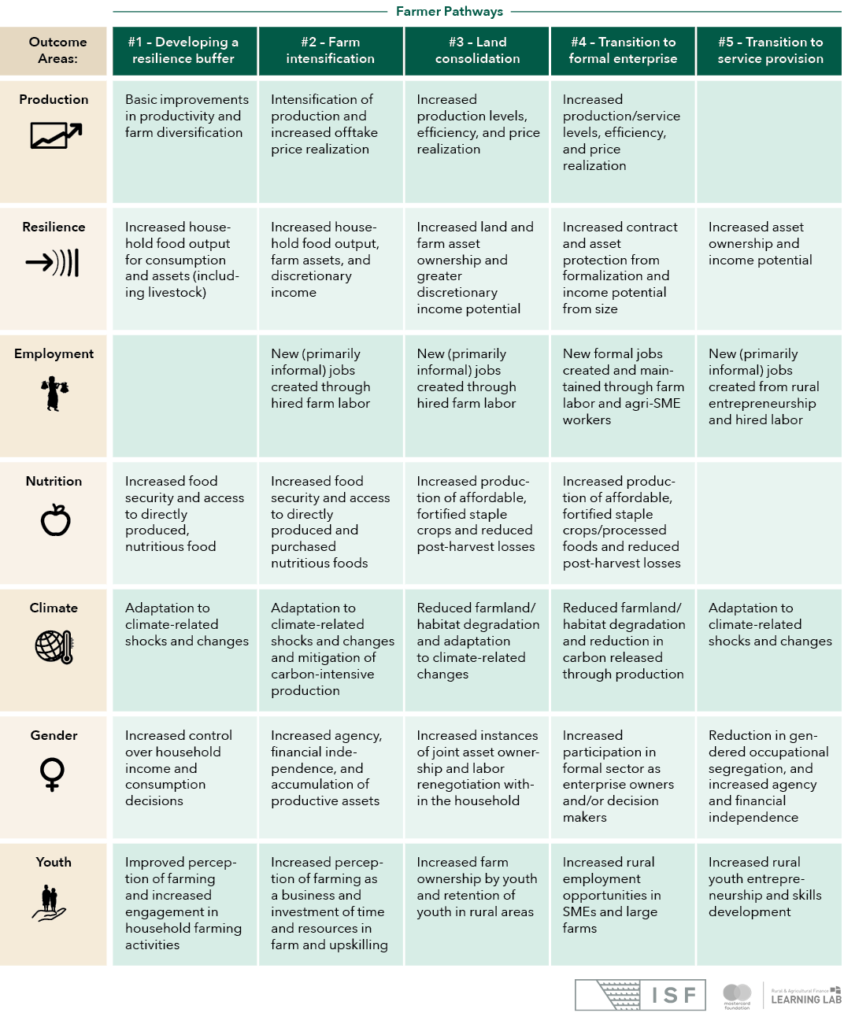

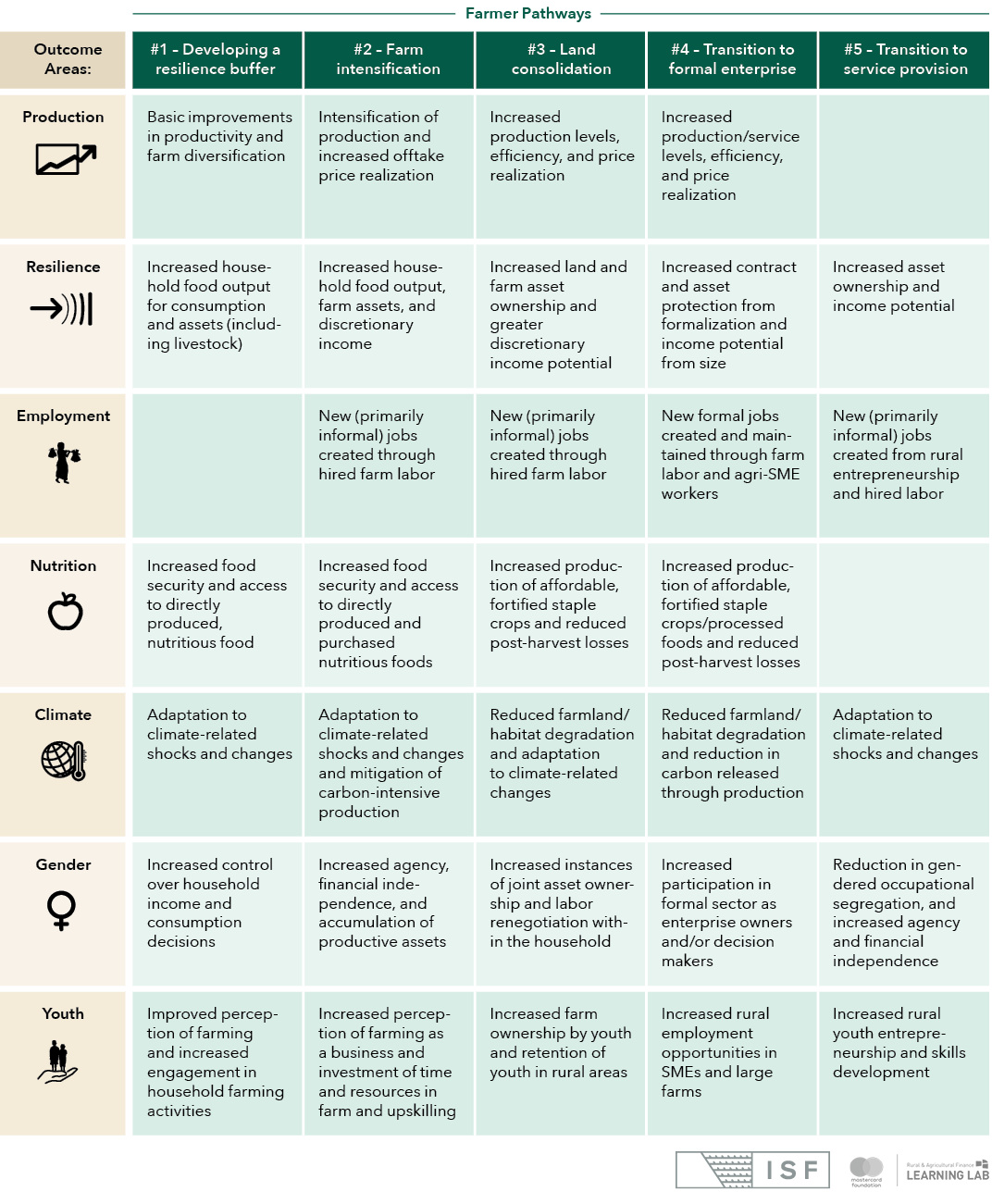

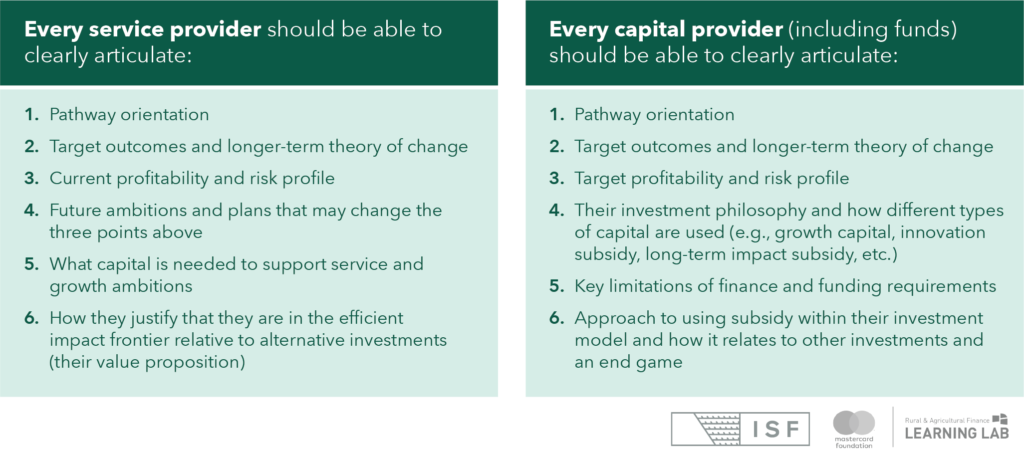

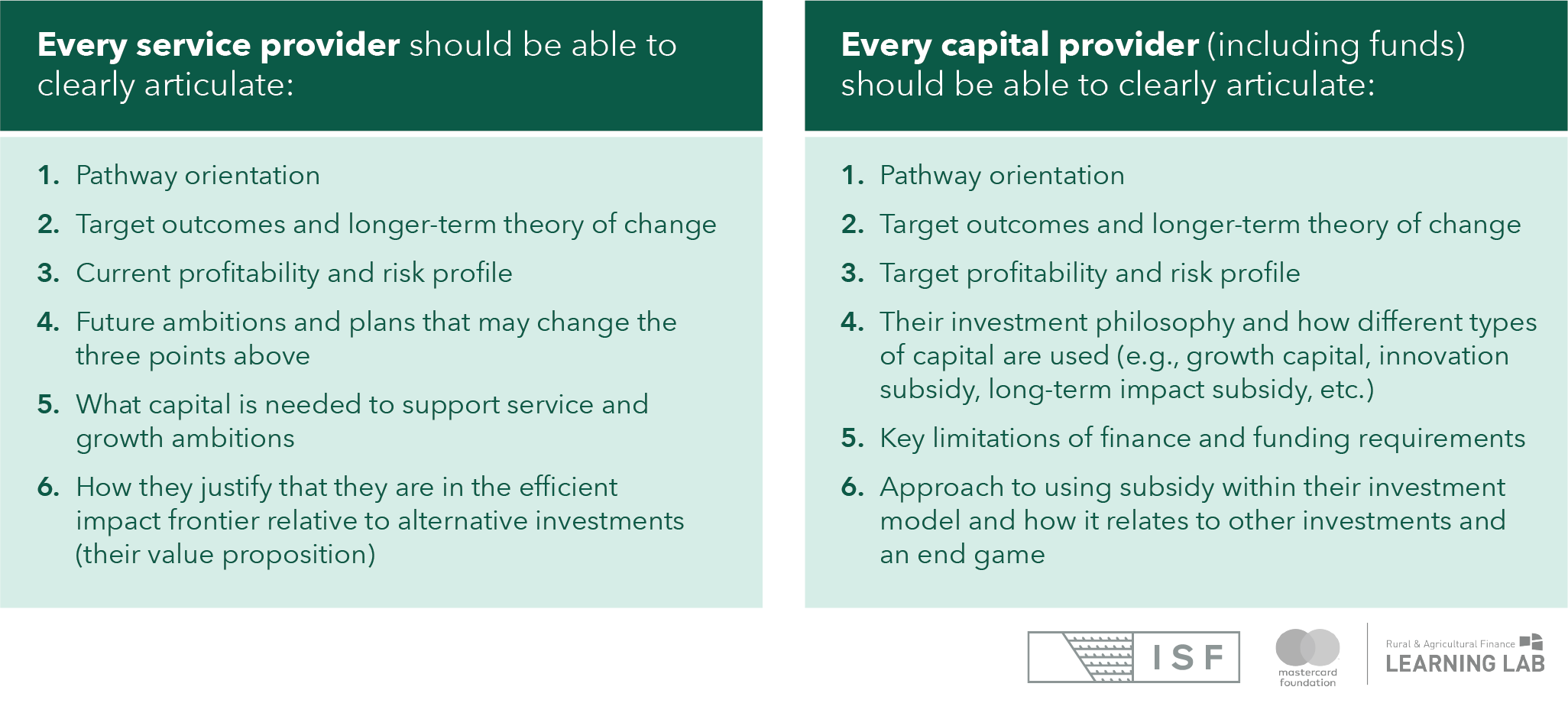

The rural pathways model enables a new way of considering the range of impact outcomes that can be generated for rural populations as they move through different transitions, creating clearer links between service and capital providers. Over time, we hope that service and capital providers will be increasingly specific about the impact outcomes they are pursuing and will establish appropriate benchmarks for success, including standardized indicators that can be used across the sector.

On the other side of the impact-return equation, it is similarly difficult to understand and compare the financial returns of different service delivery models. Many privately-owned providers are not subject to public disclosure of this data. At the same time, given the often small size of their smallholder portfolio, many providers conduct limited product and segment level profitability analysis.

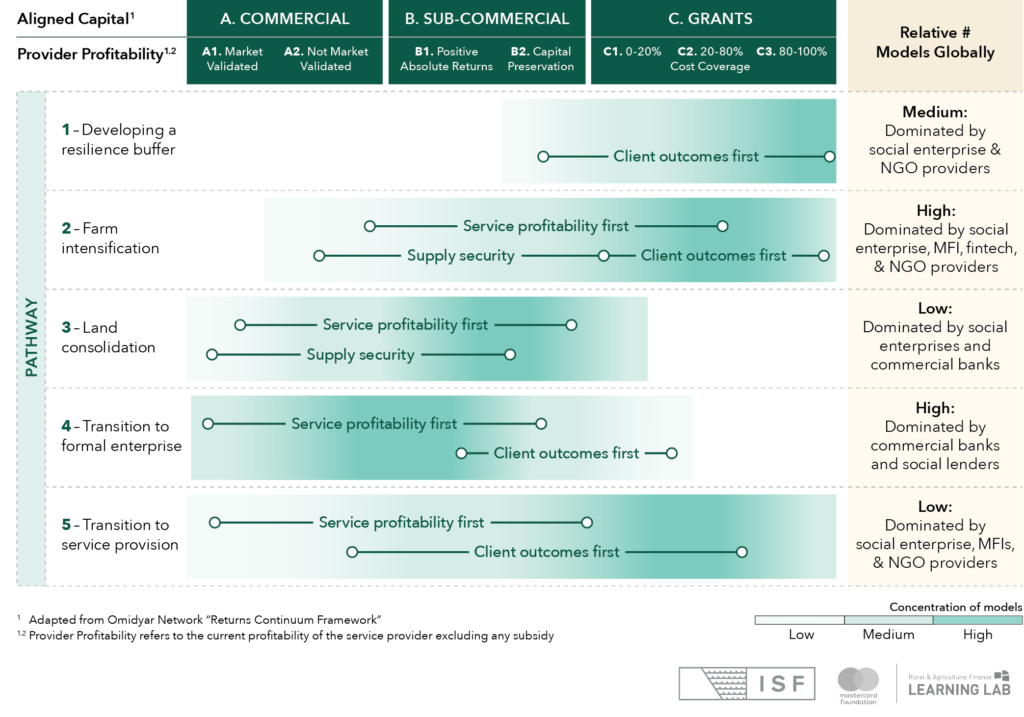

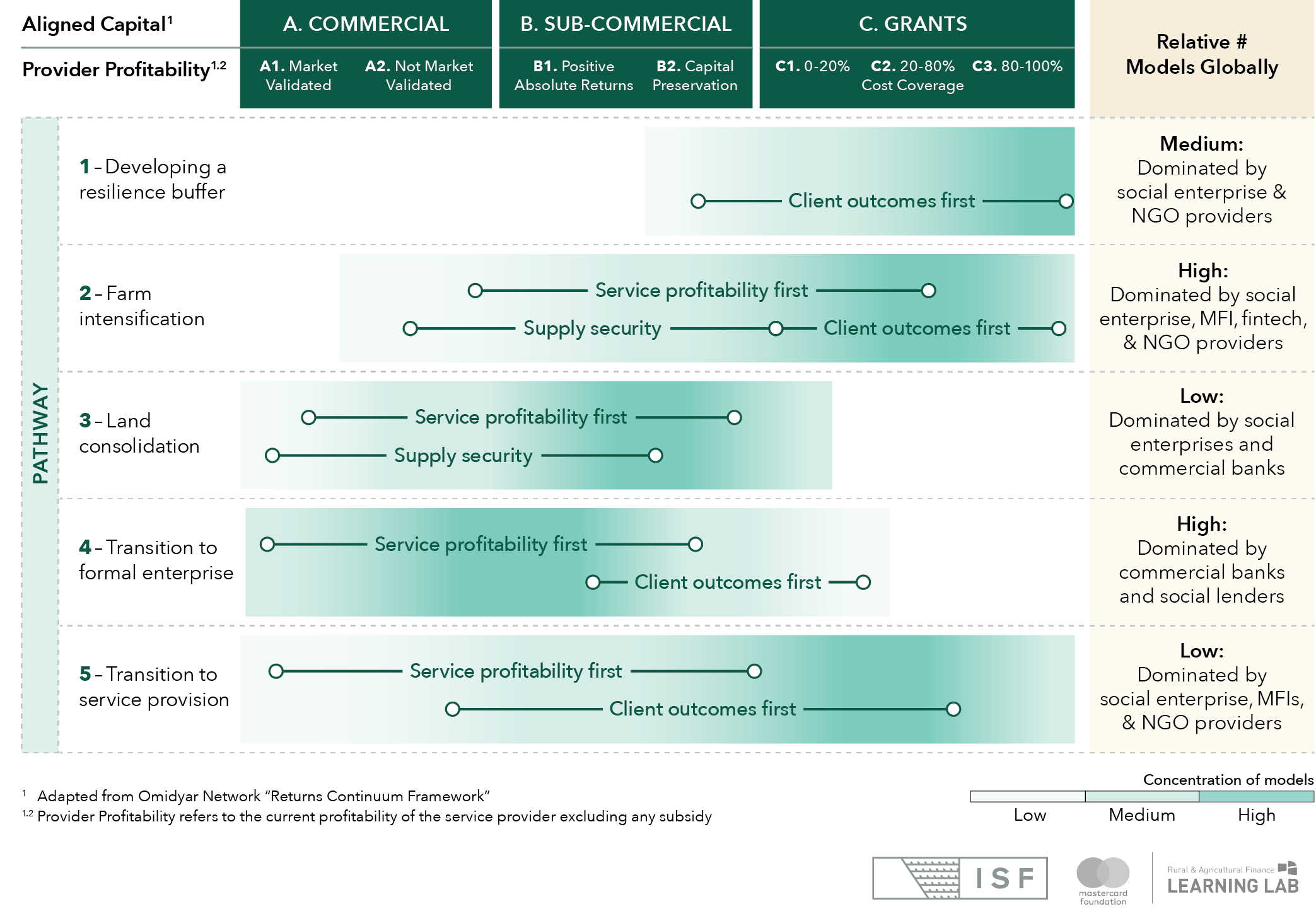

To illustrate the range and prevalence of different profitability profiles and capitalization needs found in the rural and agricultural finance space, the capital orientation map below lays out how different types of financial service provider models align to profitability profiles, types of capital, and transition pathways. In this mapping, service provider profitability is considered the current profitability of a provider excluding any subsidy—and capital types are aligned with the profitability profiles on that basis. The prevalence of service provider models is depicted as a bell curve that shows the alignment of demand for different forms of capital based on the underlying profitability of the model.

Viewing the demand for, and supply of, types of capital in this way shows the necessity of capitalizing multiple service delivery models with very different profiles.